26+ Mortgage points break even

But one point can reduce the rate more or. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

3 Lookup Formula Challenges 2 Jokes 1 Link Vlookup Week Chandoo Org Learn Excel Power Bi Charting Online

1 point will lower your interest rate from 3 to 275.

. In this example the break-even point will be 69 months 2000 divided by 29 per. What is a break even point. To determine the break-even point you divide your closing costs by the amount you save every month.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. 1 point 4000. If you choose not to buy mortgage points your interest rate will remain at.

As a result the lender typically cuts the interest rate by 025. Up to 25 cash back So you might have to pay four points to reduce your rate by a full percent. Break-Even Periods For Paying Points Based on Rules of Thumb Can Be Far Off the Mark.

Ad Todays Best Refinancing Mortgage Rates Curated for Your Needs. Calculate the difference in monthly payments to determine the amount saved each month. On a 200000 loan each point costs 2000 which means that 175 points will cost 3500.

The broker quoted above is referring to a case where a borrower who had previously agreed to pay. Cost of Points - The calculator assumes that 1 mortgage point costs 1 of the mortgage amount. This tool helps you determine whether paying paying additional charges for a specific interest rate or discount points in exchange for a lower interest rate is a good deal.

Say you buy one point on a mortgage loan of 300000 which costs. Use our extensive real estate and mortgage terms glossary to get definitions that may pertain to you. This process is also known as buying down.

Mortgage Points Calculator 11a Break-Even Period on Paying Points on Fixed-Rate Mortgages Who This Calculator is For. The result is the amount of time it would take you to breakeven on the. This is calculated by dividing the cost of points by the monthly savings generated.

Divide the amount paid for points by the monthly savings amount to get the number of. To figure out when youll break even if you buy mortgage discount points take the cost of the points and compare it to how much youll save each month if you have a lower interest rate. Borrowers who want to know whether they will save or.

Apply Get Pre Approved. Special Pricing Just a Click Away - Get Started Now See For Yourself. To find your break-even point simply divide your upfront cost by your monthly savings.

Ad Lock Your Mortgage Rate With Award-Winning Rocket Mortgage. Keep in mind that. In that scenario you could potentially save as much as 11424 in interest by buying points.

Mortgage points are fees you pay upfront to reduce your mortgage interest rate and by extension your monthly payment amount. When you buy one discount point youll pay a fee of 1 of the mortgage amount. The longer you expect.

2

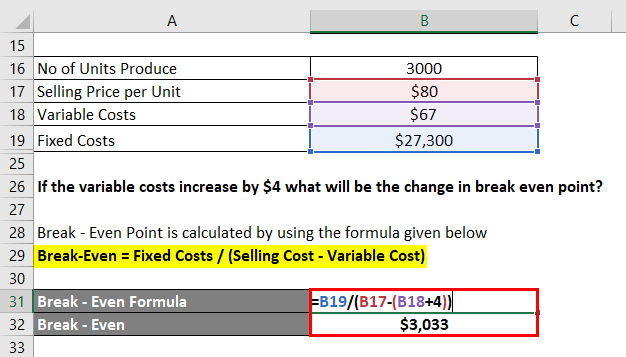

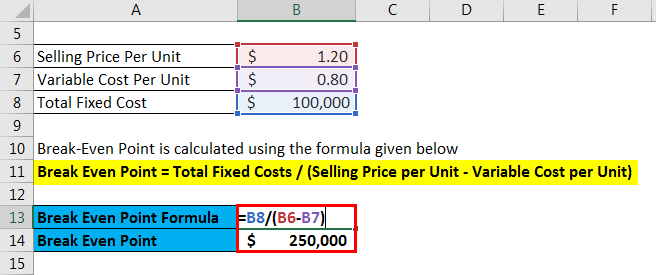

Break Even Analysis Formula Calculator Excel Template

Break Even Analysis Formula Calculator Excel Template

The Riverdale Press 03 26 2020 By Richner Communications Inc Issuu

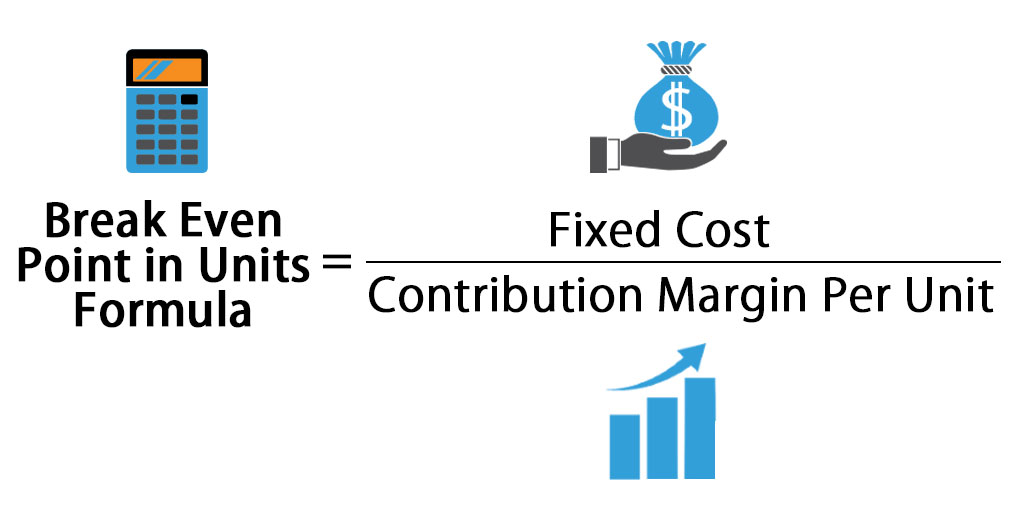

Esports In India Signal Vs Noise By Lumikai Medium

Esports In India Signal Vs Noise By Lumikai Medium

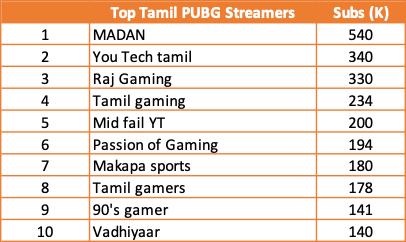

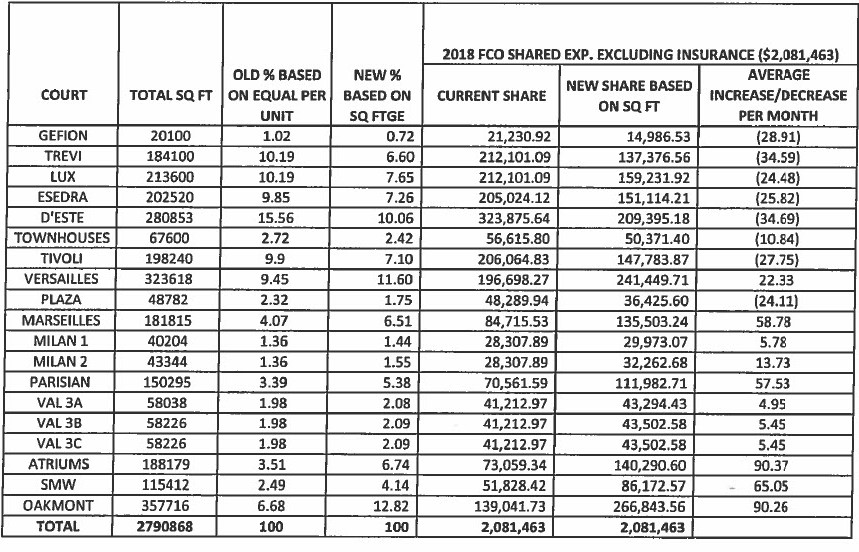

What S New Fountains Residents Network

Break Even Analysis Example Top 4 Examples Of Break Even Analysis

The Keeper 2019 By Outdoor Sports Guide Issuu

Evaluate These 5 Points Before You Make A Home Purchase Decision Home Buying Tips Home Buying Ideal Home

Maybe You Should Just Lock On That Rate That Seems Disgustingly High R Firsttimehomebuyer

Pdf Using Calculators In Mathematics 12 Student Text Gerald Rising Academia Edu

Medical Device Manufacturing Businesses For Sale Buy Medical Device Manufacturing Businesses At Bizquest

Break Even Analysis Formula Calculator Excel Template

Break Even Analysis Formula Calculator Excel Template

How To Get My Cpa Exam Score Quora

Break Even Sales Formula Calculator Examples With Excel Template